While dropshipping is a popular choice, you may wonder if dropshipping is legal or not. The answer is yes, dropshipping itself is a legal business model in all countries. However, understanding the legal landscape is crucial to avoid problems. This applies to both beginners and experienced dropshippers. Let's dive into what you need to know!

Table of contents

1. What is Dropshipping?

Dropshipping is a retail method where you, the seller, don't keep inventory yourself. A customer places an order on your online store. You relay the order details and customer information to your dropshipping supplier. The supplier packages and ships the product directly to your customer. Essentially, you act as a middleman connecting the customer to the supplier, and your profit comes from the difference between your selling price and the wholesale cost you pay the supplier.

Dropshipping is a cost-effective way to help you avoid a lot of these expenses, such as storage space rent and inventory costs. You can just focus on marketing and customer service while the supplier handles fulfillment.

To learn more: What is dropshipping and how does it work?

2. Is dropshipping legal?

Yes, dropshipping itself is a legal business model in all countries. Like in any business, you must adhere to local, national, and international laws regarding the sale of merchandise. Meanwhile, you must avoid legal troubles typically involved with false advertising, infringing on copyrights, etc.

So before starting your dropshipping business, it's crucial to gain a solid understanding of the legal landscape.

2.1 Business Registration

You may wonder if dropshippers need a business license or not. A dropshipping business is a retail business. If your state or municipality requires a business license for retailers, you probably need one for your dropshipping store.

There are several common business structures to consider for dropshipping.

Sole Proprietorship: Simplest and most common structure. You own and operate the business, with all profits and losses reported on your personal tax return. The downside is that you have unlimited liability, meaning your personal assets are at risk if the business incurs debts.

Partnership: Two or more people share ownership and management of the business. Profits and losses are passed through to each partner's personal tax return. Similar to a sole proprietorship, partners have unlimited liability.

Limited Liability Company (LLC): Provides limited liability protection for owners (called members). This means your personal assets are generally shielded from business debts. LLCs offer more flexibility in management structure than corporations and can be taxed as a pass-through entity, similar to a partnership.

Corporation: Most complex structure, with a clear separation between the business and its owners (shareholders). Offers limited liability protection and the ability to raise capital by selling shares. However, corporations come with more regulations and paperwork.

The best structure for your dropshipping business depends on your specific needs and goals. If you're running the business alone, a sole proprietorship might suffice. For multiple owners, a partnership or LLC is more appropriate. The advantage of setting up an LLC is that it separates your personal assets from your business assets. If something goes wrong and someone decides to sue your business, you can’t be held personally liable. Moreover, your personal assets can't be seized either.

If you are not sure, you can also consult with a legal or tax advisor who can help you determine the best structure for your situation.

2.2 Tax

Like any business, dropshippers are liable for taxes. Let's take an example to show the potential taxes you need to pay to help understanding.

Imagine you're a dropshipper based in the United States selling custom-printed mugs. You find a supplier in China who can create these mugs at a good price. But before you start selling, there are potential customs duties and import taxes to consider.

Scenario:

- You order 100 mugs from China, and the total cost (including materials and production) is $1 per mug, for a total cost of $100.

- Shipping from China to the US costs $50.

Customs Duties:

As you source products from outside your country, you are responsible for customs duties and import taxes. The rates depend on the specific product and its country of origin. - The mugs are classified under a specific code in the Harmonized Tariff Schedule (HTS) of the United States, which determines the duty rate. Let's say the HTS code for custom mugs has a 5% duty rate.

- Duty = (Total Cost + Shipping) x Duty Rate = ($100 + $50) x 5% = $7.50

Import Taxes: - In addition to duties, there might be import taxes like a federal merchandise processing fee or harbor maintenance fee (depending on how the mugs are shipped). These fees are usually a percentage of the total value of the goods.

- Let's assume a combined import tax rate of 2%.

- Import Tax = (Total Cost + Shipping + Customs Duty) x Import Tax Rate = ($100 + $50 + $7.5) x 2% = $3.15

Total Cost: - So, before you even sell a single mug, you've potentially incurred $7.50 in customs duties and $3.15 in import taxes, bringing your total cost per mug to $1.1065.

Sales Tax (US):

In most areas, you'll need to collect sales tax from your customers on the products you sell. The specific rate will vary by location. You then act as an intermediary and remit this collected tax to the government.

Let's say you sell the mugs at $19.90 in California . California has a statewide sales tax rate of 7.25%. When a customer in California buys a mug from your store, you collect 7.25% of the sale price as sales tax.

$19.90 x 7.25%=$1.44275

This money doesn't belong to you; you hold it temporarily and then send it to the California government. Income Tax:

You'll pay income tax on the net profit (your revenue minus business expenses) of your dropshipping business. Let's say if you sell all 100 mugs, and your net profit is Net profit = Revenue - total cost- sale tax- business expenses( such as employee, store charge etc., for example 15% of the revenue) $1990-$110.65- $144.275-15% x $1990=$1447.225

The tax rate you pay depends on your taxable income and falls within the federal income tax brackets ranging from 10% to 37%.

Let's say if the rate is 15%, the income tax you need to pay is

$1447.225 x 15%=$217.08

Since you're likely considered self-employed as a dropshipper, you'll also owe self-employment tax on your federal return. This tax covers Social Security and Medicare contributions. This is a simplified example. Tax laws can be complex, and it's always best to consult with a tax professional to ensure you're filing and paying the correct taxes for your dropshipping business. It's important to factor these potential costs into your pricing strategy.

2.3 Copyright

Copyright is a type of intellectual property right that protects original works of authorship, such as written works, music, art, etc.

As a dropshipper, you can't sell products that infringe on someone else's copyright. This includes things like:

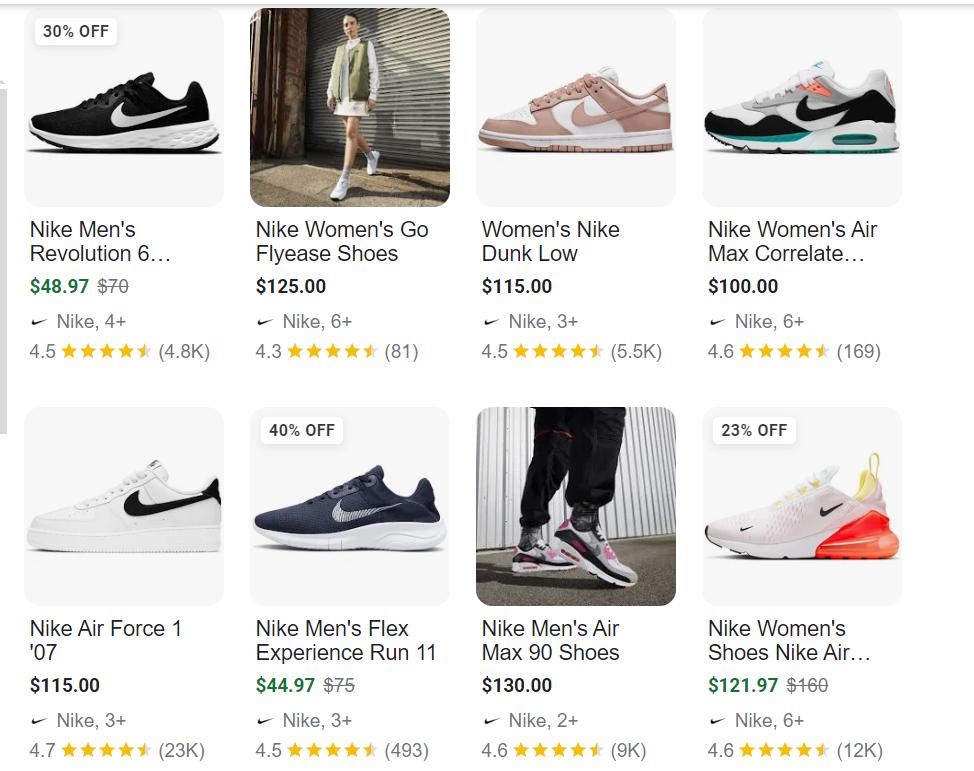

- Counterfeit items: Fake designer clothing, electronics, etc. If a product's price is significantly lower than the typical market value, it might be a counterfeit.

- Products with copyrighted designs or logos (unless you have permission from the copyright holder)

- Music or movies (these require specific licensing agreements)

2.4 Trademark

Trademarks protect words, symbols, or designs that identify the source of a particular product or service. You can't use a trademark on your products or marketing materials if it's too similar to an existing trademark, especially for related goods or services. This could confuse consumers and lead to legal action.

Before selling a product, check if any trademarks are associated with it. You can use online trademark databases or consult with a lawyer.

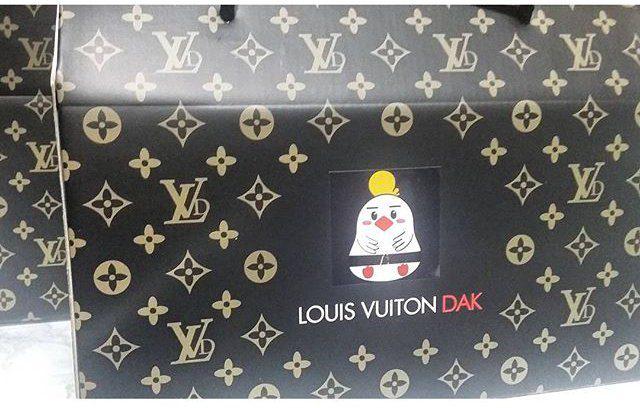

In one of the more shocking examples of international trademark infringement, is a South Korean fried chicken restaurant Louis Vuiton Dak vs Louis Vuitton. The court ruled in the designer’s favor after determining that the restaurant’s name of Louis Vuiton Dak was too similar to Louis Vuitton. Not only the name infringement, the restaurant’s logo and packaging closely mirrored the designer’s iconic imagery.

You can also create your own brand identity. Develop a unique brand name, logo, and product descriptions to avoid any potential trademark conflicts. You can use shopify logo maker tool- Hatchful to create a logo for free. They will generate versions for different uses, such as Facebook cover and profile, linkedin banner, twitter header, even transparent version of logo.

If someone are unfortunately suspected of infringement, the trademark owner can demand them stop selling the infringing product. A lawsuit for damages needs to be faced by infringement. Online marketplaces like Amazon may suspend the seller's account.

2.5 Truth in Advertising

In dropshipping, truth in advertising is a must. Building trust with customers is essential for long-term success. It's crucial to avoid misleading customers or making false claims. When customers feel misled by advertising, they're less likely to return or recommend this store. There are laws and regulations around advertising that protect consumers from deception. Violating these laws can lead to fines or even lawsuits.

Let's see some real cases to help you better understand:

In its ads, Lumos Labs claimed its app, which offers users access to games and brain training exercises, that it would help prevent Alzheimer's disease or help students perform better in school, though it had no proof. The company was fined $2 million by the FTC.

The Kellogg Company claimed Frosted Mini Wheats improved children's attentiveness by 20%. But attentiveness did not increase as much as promised in the vast majority of children who ate cereal. Kellogg agreed to a $4 million settlement and to stop using the ads.

Coca-Cola falsely claimed its Vitaminwater products could promote healthy joints, reduce the risk of eye disease, and have other health benefits. The company agreed to change Vitaminwater labels.

To avoid violating the law of truth in advertising, better follow below tips:

- Clearly describe the product's features, materials, size, and functionality.

- Use clear and accurate photos or videos of the products.

- Avoid exaggerating its benefits or capabilities.

- Don't make unrealistic promises about the product's performance or results. Focus on what the product genuinely offers.

- Be upfront about any limitations, warranties, or potential risks associated with the product. If you're unsure about a product's details, be transparent with your customers and let them know you're verifying the information. Keep up-to-date with advertising regulations that apply to your location and target audience.

2.6 Consumer Protection

Consumer protection laws are a set of regulations designed to safeguard shoppers from unfair and deceptive business practices. These laws apply to dropshippers just like any other retailer.

Even you are not the one making the products you are selling, but that doesn’t mean you are not responsible for the quality and safety of the products shipped to your customers. If your product hurts someone, you could face personal injury litigation.

You can check below Important Protections for Consumers:

- Accurate Information: Customers have the right to clear and accurate information about the products you sell, including price, features, warranties, and potential risks.

- Fair Return Policies: You must have a clear and fair return policy that outlines the conditions, timeframe, and process for returning unwanted or defective items.

- Cancellation Rights: In some cases, consumers may have the right to cancel an order before it ships and receive a full refund.

- Deceptive Advertising: False or misleading advertising is prohibited, including exaggerated claims about product benefits or deceptive pricing tactics. Consumer protection laws can be complex, and it's wise to stay informed about any updates or changes.

2.7 Legal requirement pages

So now that we've known the fundamentals, let's take a look at some legal requirement pages that you'll need in your online store.

Refund policy

While not legally required, offering a transparent refund policy is a great way to build trust with your customers. By outlining your return process, you show a commitment to customer satisfaction and encourage them to shop with confidence.

Many online resources and stores offer return policy templates to get you started. Customize one to fit your dropshipping business and clearly display it on your website.

Terms and Conditions

A terms and conditions policy is a legal document that business owners use to protect their companies. It clarifies both your rights and responsibilities, and those of your customers.

It might not be legally mandatory. However, if you face any legal issues, it may help your dropshipping business. Think of it as a user guide for your customers. It can act as a safeguard for your dropshipping business and contribute to a smoother customer experience.

Privacy Policy

A privacy policy is a legal document that explains how a business collects, uses, discloses, and protects its customers’ data. If you collect personal information from your online store’s visitors, then you must have one on your site.

Conclusion

Overall, dropshipping is legal as a low-barrier entry point for ecommerce beginners. But with opportunity comes responsibility. Protect yourself by understanding these legal requirements, prioritizing customer satisfaction, and choosing suppliers wisely.

Better work with reputable suppliers, they can help you save a lot of time by vetting products thoroughly to avoid counterfeits, copyright infringement, or safety hazards. Review and sign dropshipping supplier contracts to clarify responsibility for different stages (sales, shipping, product liability).

Click here to start a dropshipping business now with CrossborderStudio.

Meanwhile, legal knowledge is an ongoing process. As your business evolves, staying informed about relevant regulations will be essential for long-term success.